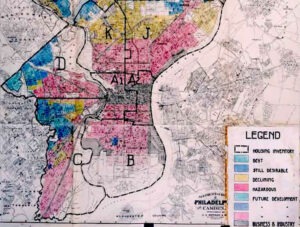

Redlining refers to lending discrimination that results from the drawing of red lines (or red shading) on bank maps to create de facto “do not lend” zones in low-income communities and communities of color.

Redlining was consolidated as a practice through the creation of federally mandated city banking maps in the 1930s. The maps continued to be used until the passage of the 1968 Fair Housing Act and still greatly influence housing today.

How did this occur? In the 1930s, during the New Deal, the federal government became the national guarantor of home loans. But not all benefitted. Rather, under the direction of appraiser Frederick Babcock, real estate maps were drawn using color shades to designate different levels of lending risk. The highest risk color was red; the red areas were overwhelmingly populated by people of color.

Enforced by then-legal “housing covenants,” racial housing segregation already existed. What redlining, did, however, was ensure that federal housing subsidies went nearly exclusively to Whites. Between 1930 and 1960, Black Americans received only one percent of all federally subsidized mortgages. It has been estimated that if racial disparities in homeownership rates caused by differential access to credit were eliminated, the Black-White wealth gap would shrink by 31 percent.